How to Remove Hypothecation From RC after Car Loan Termination?

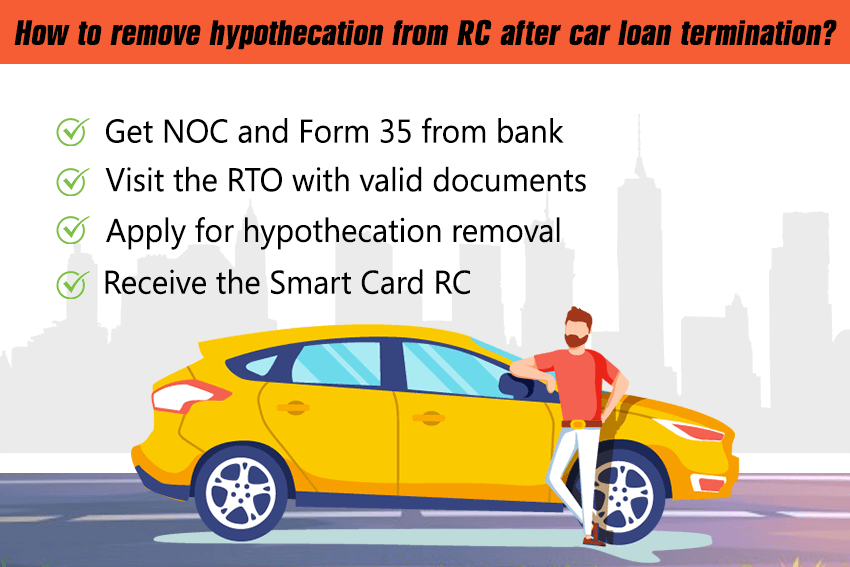

It is vital to remove the hypothecation from RC once the loan has been repaid. In case of a house loan, this process necessitates just telling the local bank to close the loan. However, in the case of a car loan, this process is a little complex. Aside from the bank you also have to file an application at the Regional Transport Office. This is due to the fact that when you purchase a car on loan, the vehicle is in the name of the bank as the bank paid the money to purchase the same. The name of the bank is endorsed on the Registration Certificate. You will have to change the same once the entire loan amount is repaid.

This process of transfer of ownership from the name of the bank to the name of the owner is call removal of hypothecation. In case you are unable to pay the loan amount, the lender who is the bank will have control of the asset. When you have repaid the loan it is vital to collect two documents from the bank:

No Dues or No Objection Certificate (NOC) from the bank. This connotes that the bank has no objection of any kind to remove the hypothecation. You need to collect two copies of Form 35. This states the conclusion of the hypothecation agreement between the bank and the person who has taken the loan.

Banks generally take around two to three weeks to send No Objection Certificate (depending upon the type of institution or bank) once you have cleared the entire loan amount. In case a person pays the loan before the due date, he/she is charged with a prepayment penalty. Usually a prepayment penalty of 2% is charged on the principal amount or the amount which you wish to repay. Once you get the No Objection Certification, all you need to do is visit the RTO (i.e. Regional Transport Office) and get the hypothecation removed from your vehicle’s registration and your smart card. A little groundwork needs to be done before this.

You have to collect certain documents prior to going to RTO.

- Original copy of NOC issued by the bank

- Original copy of RC

- Original Form 35 (basically 2 copies which are duly signed by the bank as well as the registered owner)

- Attested copy of valid insurance

- Attested copy of valid Pollution Under Control certificate

- Attested copy of your PAN Card

- Attested copy of Address Proof

And in case your current address is not the same as what is mentioned on your RC, you will require Form 33 so that you can furnish change of address. Besides all of this, you will also require to get in touch with your insurance company. You will have to submit a copy of the No Dues Certificate that the bank has given you and forward the same to the insurance company which offers comprehensive insurance for your car so that hypothecation is removed even from their books.

Once all this work is done properly you will get a written confirmation from all the concerned parties that process is complete– always check twice to make sure that work is done properly.

This procedure of amassing all documents from the bank is quite tedious particularly in case you are working with any public sector bank. Basically, no bank is keen to close down the loan as this means loss of business for them. Also, some banks would want you to run around in order to demoralize you. The experience with RTO is also not that great. You might have to visit RTO several times so that your work gets completed.

Also Read:- RTO Forms: Types, Meaning, and Significance