India as a country is faring much better than the world in terms of confidence levels in business thanks to the new government. And it is in that sense that the upcoming budget has a huge task of satisfying all the industries on so many levels, without hurting much of the sentiments. The automobile industry has been seeing some growth recently when compared to previous months but the cancellation of excise duty cut in December 2014 has hurt its chances to leap forward. Revisal of excise duty rates, implementation of Goods and Service Tax (GST), customs duty cut and lower interest rates are some of the major expectations from the automobile industry of the 2015 Union Budget.

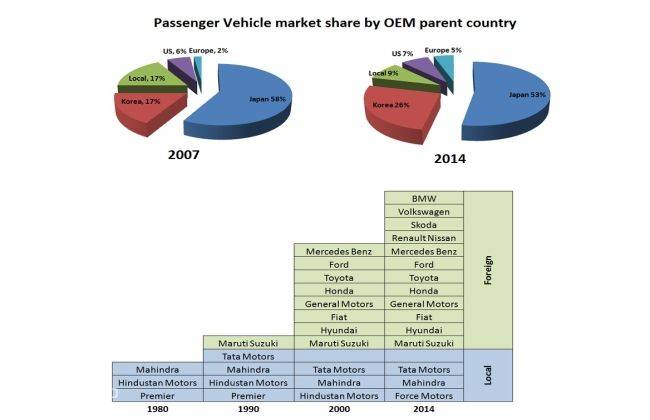

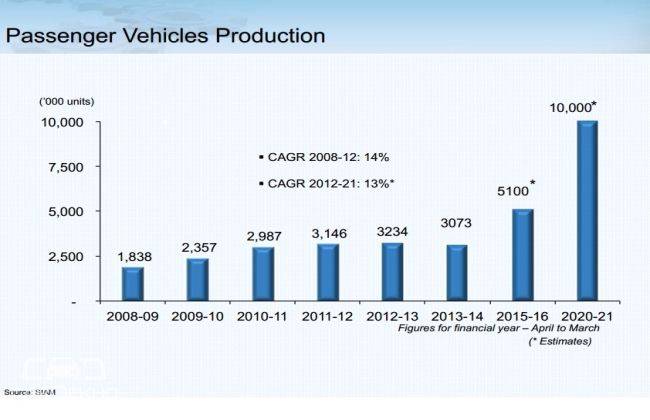

India is currently the largest tractor manufacturer, 2nd largest two-wheeler manufacturer, 6th largest car manufacturer, 2nd largest bus manufacturer and 8th largest commercial vehicle manufacturer in the world. So, automobile industry as a whole acts as a major contributor to the growth of economy in India without a doubt. Here’s a look at how the passenger vehicle industry has fared so far. The illustrations below show how much Indian automobile industry has attracted foreign automobile brands have come and conquered in India and the growth of the production. Mr. Narendra Modi’s “Make in India” program which includes new initiatives designed to facilitate investment, foster innovation, protect intellectual property, and build best-in-class manufacturing infrastructure is sure to bring in more global brands.

Automobile Industry’s wish list:

Excise duty revisal:

While automobile makers rejoiced when it was announced that the excise duty cut will be extended till December 2014, the new government didn’t heed any requests of the automaker to further extend the cut. The excise duties went back to their original numbers and as a result, we saw all the manufacturers increasing the prices to accommodate the changes in cost. Never-say-never automakers are still hopeful that the upcoming budget will be more supportive in the form of revised excise duties. Federation of Automobile Dealers Association (FADA) has requested for identical excise rates for all passenger vehicle segments.

Goods and Service Tax (GST) implementation:

GST has been discussed and argued for so many years now and hopefully, the new budget will provide more definitive answers about its implementation. If the GST is rolled out, the automotive industry will benefit as the GST rates are expected to be much lesser than the current excise plus VAT rate.

Lower interest rates:

When you have over 80% of the vehicles bought in India through loans, it’s only logical to lower the interest rates leading to increase in sales. The interest rates have been kept steady in view of the upcoming budget and we have to wait till the budget is announced whether to celebrate or to mourn.

Incentives for electric and hybrid cars:

Electric and hybrid cars have never been a popular choice for Indian consumers and most of the blame should be on lack of proper infrastructure like public charging points and some tax incentives for that little push towards them.

Customs duty:

Imported cars now bear a customs duty of more than 125%. Automakers hope that the government let the customs duty unchanged. A reduction in customs duty would also receive great applause.